In New World of Military Spending, Small Is Beautiful

By JAMES FLANIGAN

9

|

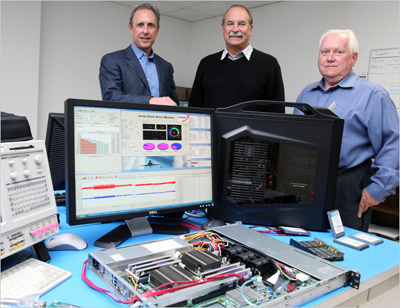

| Jon B. Kutler, left, founder of Admiralty Partners, with Gerald Smith, center, and Roydn Jones of Trident Space and Defense. Trident sells solid-state drives from computing devices. |

AT one time, it may have been true that “an army marches on its stomach.” But with food supplies generally not a problem for modern armies, the proverb should probably be updated to something like this: an army marches on its laptops and the information flowing through them.

And that means opportunity for small military contractors, even in a time of constrained budgets.

Jon B. Kutler, founder and chairman of Admiralty Partners in Los Angeles, who has invested about $70 million in several small military contractors in the last seven years, said he thought financing for crucial technologies like communications would “fare very well in the next three to five years.” He said military spending was at a turning point “in that it is not in vast programs for aircraft or mammoth undertakings that take 10 years to complete, but smaller companies in fields like cybersecurity.”

Mr. Kutler, a onetime naval officer, said that American forces in Iraq and Afghanistan were fighting dispersed smaller groups. “That demands communications and sensors and all manner of technology,” he said. “Communications needs to be at the level of individual soldiers. And it must be secure from the enemy, too. So we need surveillance and security of information and reconnaissance to see the enemy.

“All of this will see increased spending,” he said, “but that can come in small companies and programs.”

Loren B. Thompson, a longtime defense analyst and chief operating officer of the Lexington Institute in Arlington, Va., predicted that “the Pentagon will be the biggest consumer of information systems and software in the world for the foreseeable future.”

That trend is likely to favor companies like Trident Space and Defense of Torrance, Calif., which is owned by Admiralty Partners. Trident “had its best year ever in 2008, is doing well this year and we look for growth next year,” said Gerald Smith, vice president and general manager.

Trident makes components for satellites that are in demand as surveillance increases. It also provides ground systems and tracking services for satellite programs of countries around the world. The company, which has 70 employees and about $45 million in annual revenue, also makes solid-state drives for laptop computers that are intended to withstand battlefield conditions.

Trident, a 33-year old company, started out selling components internationally as a division of TRW, an early defense firm acquired by Northrop Grumman in 2002. In 2007, Admiralty Partners bought the operation that is now Trident and expanded its operations, in domestic markets and internationally.

Other investments by Mr. Kutler’s firm include AmSafe Aviation in Phoenix, which makes seat belts and harnesses for the airline industry, and Pankl Aerospace Systems, of Cerritos, Calif., which supplies helicopter drive shafts and other equipment.

For Trident, Mr. Smith said, the solid-state drives and other systems might become the largest part of the business in the next few years. The attraction, said Roydn Jones, the company’s chief technology officer, was that computers with solid-state drives, as opposed to more common rotating drives, could operate in desert heat or other adverse conditions “and they can be dropped from the back of a Humvee and continue to work.”

Until recently, solid-state drives were less common because they were more expensive. But prices have come down, Mr. Jones said, because solid-state electronics in MP3 music players and similar devices turned them from a niche to a mass-market product.

The mingling of commercial and military technology is characteristic of military programs these days, said Eric M. DeMarco, chief executive of Kratos Defense and Security Solutions. He cited a product made by his company, NeuralStar, which helps make computer systems more secure from tampering by hackers, spies and other attackers. The NeuralStar system “has a contract to manage the whole flow of information across many levels of a government department,” he said. “That product originated in commercial telecommunications.”

In the future, Mr. DeMarco said, he expected to see more use of unmanned systems. “Not only aircraft but robots and ‘Terminator’ type warfare.”

At the same time, he predicted, those products would also be used in civilian and commercial programs. “I would see unmanned systems used in crop dusting and surveillance and fighting of forest fires,” he said. And communications will be critical, he said. “With all unmanned systems, command and control must be maintained and protected, down to the individual war fighter. It’s not top-down information but distributed throughout the command.”

Kratos, based in San Diego, grew in recent years by acquiring small defense and technology companies. It has just refinanced with a $19 million sale of stock through B. Riley & Company, a Los Angeles investment bank. Mr. DeMarco said the money would be used to pay down debt and perhaps to make an acquisition of a small company in electronics and optical technology. “The recession opens opportunities,” Mr. DeMarco said.

John Keating, chief executive of Com Dev International, a Canadian company that recently invested in the United States, said he also expected a sharing of technology for commercial and military uses. “Rather than building a separate satellite program, military payloads will share space on commercial communications satellites,” said Mr. Keating, whose company has been a supplier for the last 40 years of electronics and optical subsystems to the former Hughes Aircraft and Boeing Company and other makers of communications satellites.

In 2006, the company, based in Cambridge, Ontario, invested $25 million to create Com Dev USA in El Segundo, Calif., to bid for military and civil government satellite business in the United States. Mr. Keating said he saw a special area of business growth. “The world satellite business will grow only moderately in the coming years,” he suggested, “but we have technology and many other products and services we can bring into U.S. markets.”

What those investment patterns suggest, said Mr. Thompson of the Lexington Institute, is that overall military spending — currently at $680 billion in the fiscal 2010 budget — “will probably decline in years ahead.” But, he added, “second-tier defense contractors focused in information technology and intelligence applications will probably do well in the emerging military market.”