|

|

|

|

|

|

|

Alliance Spacesystems, LLC is a leading supplier of lightweight composite structures to the satellite manufacturing industry and other related markets. Located in Los Alamitos, California, the company's capabilities range from design/analysis and composite manufacturing to assembly, integration and test of complex precision structures (www.alliancespacesystems.com).

Formerly a subsidiary of MacDonald, Dettwiler and Associates, Ltd. (TSX:MDA), the company was acquired in approximately six weeks, in December 2012. Under Admiralty Partners ownership, the company grew rapidly and invested in new technologies in support of customer needs. In recognition of these initiatives, Alliance received an unsolicited offer from SolAero Technologies, and was acquired in April, 2015. |

|

|

|

| AmSafe

Aviation manufactures passenger seat

belts, flight attendant harnesses, pilot/co-pilot

restraint systems and the new benchmark

in air safety, the AAIR inflatable restraint.

With more than 30 years in the commercial,

business jet and general aviation restraint

business, AmSafe Aviation has delivered

millions of seatbelts worldwide. |

|

| AmSafe

Commercial Products provides restraint

systems and performance textile solutions

for applications including child seats,

school buses, trucks, recreational vehicles

and other ground based vehicles. AmSafe

Commercial Products also manufactures

and distributes a full line of securement

products for ground freight applications

including tie-downs and van hardware. |

AmSafe

Bridport manufactures aviation cargo

nets and restraints, including 9G barrier

nets, pallet nets and cargo containment,

camouflage and other aviation securement

products. In addition to its own products,

AmSafe Bridport has a global customer

service and distribution organization

for over 20,000 lines of stock for military

and commercial aircraft maintenance

organizations in 25 countries.

|

|

|

| AmSafe

Defense manufactures safety, securement

and other performance textile products and

fabrics for defense applications.AmSafe Defense

provides solutions to worldwide government

vehicle, logistics and maintenance organizations,

including personnel restraints, airbags, camouflage,

engineered cargo control systems, cargo nets

and tie downs and helicopter under-slung lifting

systems. |

| In October, 2007

AmSafe

(www.AmSafe.com)

was sold to affiliates of Berkshire Partners LLC and Greenbriar Equity Group LLC. Admiralty Partners continued to own and manage certain assets which were excluded from the sale; remained the largest investor (after the two new sponsors) in the company; and Jon B. Kutler, Admiralty's CEO, remained as a director. |

|

|

| In February, 2012, Admiralty Partners, Inc. realized its second AmSafe liquidity event when the company was sold to TransDigm Group, Inc. (NYSE:TDG) for approximately $750 million. |

|

|

Arotech Corporation (NASDAQ: ARTX) is an innovative engineering solutions company that offers Training & Simulation and Power Systems solutions to military, law enforcement and homeland security markets. The Power Systems Division develops special purpose batteries, smart chargers and electronic components

through operations in South Carolina and Israel. The

Training & Simulation Division develops, manufactures and markets

advanced multi-media and interactive digital solutions for engineering,

use-of-force and operator training simulations in Michigan.

In February, 2016, Admiralty purchased 1.5 million shares

of common stock from the company. Combined with open market purchases

by affiliates, this represents over 6% of Arotech’s outstanding

shares. API CEO Jon Kutler has been appointed to the board of

directors to help facilitate the company’s growth and value

creation plans.

In December, 2019, Arotech was taken private by an affiliate of Greenbriar Equity Group, L.P. as part of a growth plan which included the acquisition of Inter-Coastal Electronics, LLC. |

|

|

|

| Composite Structures was first

acquired an independent supplier of composite

and metal bond structures and assemblies,

in 1997 when it was a $40 million company.

While its decades-long contracts for Apache

Helicopter blades and Boeing 737 and C-17

parts were solid, the firm required significant

restructuring of both marketing and production

processes as it made the transition from a

division of a multi-billion dollar Fortune

500 company to a stand alone company. With

our guidance, Composite Structures reduced

costs and increased efficiency through techniques

such as lean manufacturing. As a result, the

company grew to have revenues of $65 million

with more than 350 employees. In 2001, Admiralty

Partners and its founder sold Composite Structures

to Ducommun Incorporated, which now operates

it as Ducommun AeroStructures. Today, the

firm is the United States' largest independent

supplier of composite and metal bond structures

and assemblies, including aircraft wing spoilers,

helicopter blades, flight control surfaces

and engine components. |

|

|

GMA Cover Corporation is a global leader in the design, development and manufacture of engineered textiles for military applications. These include soft vehicle covers, camouflage systems and parachutes.

When GMA approached Admiralty in May, 2011, it was facing twin crucial challenges. It had to perform on the rapid initiation of a large one time urgent and compelling contract to support U.S. troops in the Middle East while facing an impending bankruptcy filing due to the financial leverage it incurred associated with recent investments and the vagaries of the defense procurement process. GMA required both a quick financial restructuring and strategic guidance. Affiliates of Admiralty Partners restructured the company's balance sheet and provided it with a line of credit through a newly formed corporate structure in June, 2011, less than six weeks from the first introductory call.

In the following year, GMA grew its work force by a factor of five in order to successfully complete its contracts. As part of the restructuring process, operations were consolidated and excess facilities were sold. The company's largest product line, the sale of proprietary ULCANS (Ultralight Camouflage Net Systems) was sold to a large European defense contractor. |

|

|

|

|

| Hydra-Electric Company is a leading aerospace sensor and switch company. It was bequeathed by Hydra's founder, Mr. Allen V.C. Davis, to a major not-for-profit institution in 2016. Rather than Admiralty Partners purchasing the company, Jon Kutler acted as an uncompensated advisor in growing the company and positioning through to a eventual sale to Loar Group in 2019 which provided a significant increase in value and liquidity to the endowment of that institution. |

|

|

|

| Integral Aerospace, LLC was formed by Admiralty Partners to acquire the 270,000 sq. ft. Santa Ana, California operations of GE Aerospace as of December 31, 2016. The business traced its roots back over 50 years through various GE acquisitions. By 2016, however, the company was nearing liquidation. Through investment of capital, expertise and supplementing the management team, Admiralty assisted Integral in dramatically turning around the business and becoming a leading manufacturer of flight-critical products including carbon fiber external fuel tanks for U.S. Navy aircraft, landing gear for helicopters and advanced unmanned vehicles and a variety of complex machined structures and engine components. In July, 2021, Integral was sold to PCX Aerosystems. |

|

|

|

| Incorporated in

1988, ISX quickly grew to be a recognized

leader in developing advanced innovative information

technology solutions through an integrated

set of consulting, development and support

services for primarily government customers.

In 1991, the company separately incorporated

IS Robotics to create micro-robotics (IS Robotics

was spun off in 1998, was renamed iRobot and

went public in November, 2005). ISX was later

named ARPA contractor of the year and continued

to grow in advanced program development. Admiralty

Partners, through one of its Quarterdeck predecessor

companies, invested in ISX in 1994 as the

company opened a Washington DC office and

expanded its government capabilities. In June,

2006, ISX was acquired by Lockheed Martin

Corporation. |

|

|

Headquartered in St. John's, Newfoundland in Canada, Marport provides innovative software solutions and products for a wide variety of underwater sensing and communications applications.

Unlike traditional sonar designs, Marport's software-centric sonar platform is unique in that it supports dynamic re-configuration of multiple functions, waveforms and signal processing techniques (www.marport.com).

In December, 2010, Admiralty Partners, Inc. made a passive investment in support of the acquisition of Marport by Hastings Equity, LLC, a middle market private equity firm. In 2013, the company was sold in two transactions. Marport's Commercial Fishing business was sold to Airmar Technology and its C-Tech defense unit was sold to Nautel Capital Corporation. |

|

|

|

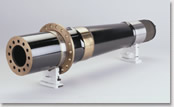

| Pankl

Aerospace Systems, (www.panklaerospace.com),

a subsidiary of Austrian public company Pankl

Racing Systems AG, is a leading provider of

a range of products for aerospace and defense

markets including helicopter main and rear

rotor drive shafts; in-air refueling system

components and jet engine shafts. In 2006,

Admiralty Partners acquired of a 25% equity

stake which includes the aerospace subsidiary’s

Cerritos, California (USA) and Kapfenberg

(Austria) production facilities. In 2010, Admiralty partners sold its position back to the Company. |

|

|

|

|

| Quarterdeck Investment

Partners, Inc. ("QIP") was founded

in 1992. QIP grew quickly from one person

in Los Angeles to four offices worldwide with

a reputation as the leading global provider

of merger and acquisition advisory services

to the aerospace, defense, space and federal

information technology markets. In March of

2001, QIP formed Quarterdeck Investment Partners,

LLC (“Quarterdeck”) to facilitate

the sale of a minority interest in its advisory

practice in conjunction with a broad strategic

alliance with Jefferies Group, Inc. (NYSE:

JEF) and its principal operating subsidiary,

Jefferies & Company, Inc. The relationship

was further expanded in April 2002 through

the creation of Jefferies/Quarterdeck, LLC

in order to offer Jefferies' financing capabilities

to Quarterdeck's broad range of industry clients.

Quarterdeck was named "2002 Boutique

Middle-Market M&A Firm of the Year"

by Mergers and Acquisitions Advisor. QIP's

remaining interest in Quarterdeck was sold

to Jefferies in December, 2002. Jon B. Kutler

continued to serve as Chairman and CEO of

Jefferies Quarterdeck, the successor business

until his resignation in 2006. |

|

|

| SEA

CON® Phoenix, Inc. is the leading

manufacturer of underwater electrical

and optical connectors, cable assemblies

and hull penetrators for military and

commercial markets. This includes devices

for a range of harsh environments such

as undersea, downhole and nuclear applications.

Headquartered in Westerly, Rhode Island,

the company utilizes a high level of

technical support to customize over

1,000 different product styles to fulfill

demanding applications. SEA CON®

was purchased by Admiralty Partners,

Inc. and its affiliates in March, 2005.

In February 2006, SEA CON® sold

Optix, its fiber optic components business

that serves the optical network market,

to management. Admiralty worked with

management to rapidly grow the company’s

backlog and establish a specialized

facility in the United Kingdom in support

of BAE’s work on the Astute submarine

program. In April, 2007 Seacon Phoenix

was acquired by AMETEK, Inc. a leading

global manufacturer of electronic instruments

and electromechanical devices. |

|

|

|

|

TeleCommunication Systems, Inc. (TCS) (NASDAQ: TSYS) is a world leader in highly reliable and secure mobile communication technology. TCS infrastructure forms the foundation for market leading solutions in E9-1-1, text messaging, commercial location and deployable wireless communications. TCS is at the forefront of new mobile cloud computing services providing wireless applications for navigation, hyper-local search, asset tracking, social applications and telematics. Millions of consumers around the world use TCS wireless apps as a fundamental part of their daily lives. Government agencies utilize TCS' cyber security expertise, professional services, and highly secure deployable satellite solutions for mission-critical communications. Headquartered in Annapolis, MD, TCS maintains technical, service and sales offices around the world. To learn more about emerging and innovative wireless technologies (www.telecomsys.com).

Admiralty Partners became the largest shareholder of TCS aside from the holdings of the Company’s founder in January 2011. Jon B. Kutler, API’s Chairman and CEO served as director of TCS and ultimately a member of the Special Committee of the Board reviewing strategic alternatives. In December, 2015, TCS entered into an agreement to be sold to Comtech Systems, Inc. |

|

|

|

|

In March, 2007 Admiralty Partners acquired the Aerospace and Defense business

units of Vertical Circuits, Inc. (VCI).The

new company, renamed, Trident

Space & Defense, LLC (www.tridentsd.com),

is headquartered in Torrance, California.

VCI was formed by the merger of TRW Components

International, a unit of TRW, Inc., now

a subsidiary of Northrop Grumman Corporation

and Cubic Memory Inc., in October 1999.

|

|

| Trident

Electronics Components Group is an ISO

9001:2000 certified engineering services company

specializing in the value added supply of

parts utilized in space, military, and other

high reliability applications for U.S. and

Global markets. With proven performance for

the past thirty years, having been originally

established as TRW Components International

in 1976, the Electronics Components group

has provided components for over 100 major

space, military and high reliability programs.

The experienced program management, components

engineering, quality assurance, and procurement

staff has supplied over 10,000 different part

types, millions of individual parts and has

a track record of zero-on-orbit failures or

launch delays attributable to their parts. |

| Trident

Advanced Products Group is a world leader

in the supply of advanced high-performance

semiconductor packaging solutions for Military

and Aerospace applications. The Group provides

innovative custom design of multi-chip modules,

“systems-in-a-package”, dense

memory modules as well as solid-state drives

in both rugged enclosures and component level

devices for embedded computer applications.

The Advanced Products Group has extensive

experience and know-how in all aspects of

the design, qualification, radiation testing

and qualification requirements for a wide

range of product designs, with past experience

supporting major programs like Cassini, NMP,

Astrolink, EOS, Landsat-7, THAAD, Kompsat

and AEHF. |

|

| Ground

Systems Group offers complete engineering

services for all ground station related business,

specializing in launch support, range safety

and satellite TT&C systems. Trident has

an excellent record of on-time delivery of

systems for over 35 years at the Global level,

as well as providing OEM support of multiple

ground stations requiring expertise in international

relations and long-term cooperative agreements.

|

|

| In 2011, Admiralty Partners sold Trident to NASDAQ listed TeleCommunications Systems, Inc. (TCS) for a combination of cash and stock. Based in Annapolis, MD, the company is a world leader in highly reliable and secure mobile communication technology. As part of the transaction, Jon B. Kutler, API's Chairman and CEO, has agreed to serve as a director of TCS. |

|

|

|

| One of Admiralty’s predecessor

companies Quarterdeck Public Equities, LLC

purchased approximately a 10% position in

the fully diluted stock of this formally public

micro-cap company, making it Venturian’s

second-largest shareholder after the founder’s

family. Through its wholly owned subsidiary

Napco International, Inc, Venturian provided

a wide array of defense products to commercial

and government customers. In addition, Venturian

owned several non-core assets including substantial

real estate and financial holdings for which

the public markets were not ascribing value.

With Admiralty’s principals’ assistance,

the company was able to go private and recognize

significant value in a series of independent

transactions. |

|

|

|

|